.jpeg?width=749&name=pexels-photo-3183197%20(1).jpeg)

HOW AGILITY AND DECISIVE ACTIONS CAN PREPARE THEM FOR THE FUTURE.

To thrive in the future, advisory firms may need to expand both their demographic makeup and their service offerings. As U.S. demographics change, advisory firms face a mismatch between their highly homogenous industry and the increasingly diverse workforce at large.¹ Smaller firms may face challenges in broadening their practices, but they also have a unique advantage: a great deal of control over their direction.

EXPANDING DIVERSITY AND SERVICES

The FlexShares Advisor Teams and Diversity Study finds that investors are much more likely to work with advisors with whom they share demographic traits—suggesting that firms may benefit if their staffs include advisors with a variety of backgrounds and life experiences.

KEY BUSINESS INITIATIVES FOR ADVISORY FIRMS

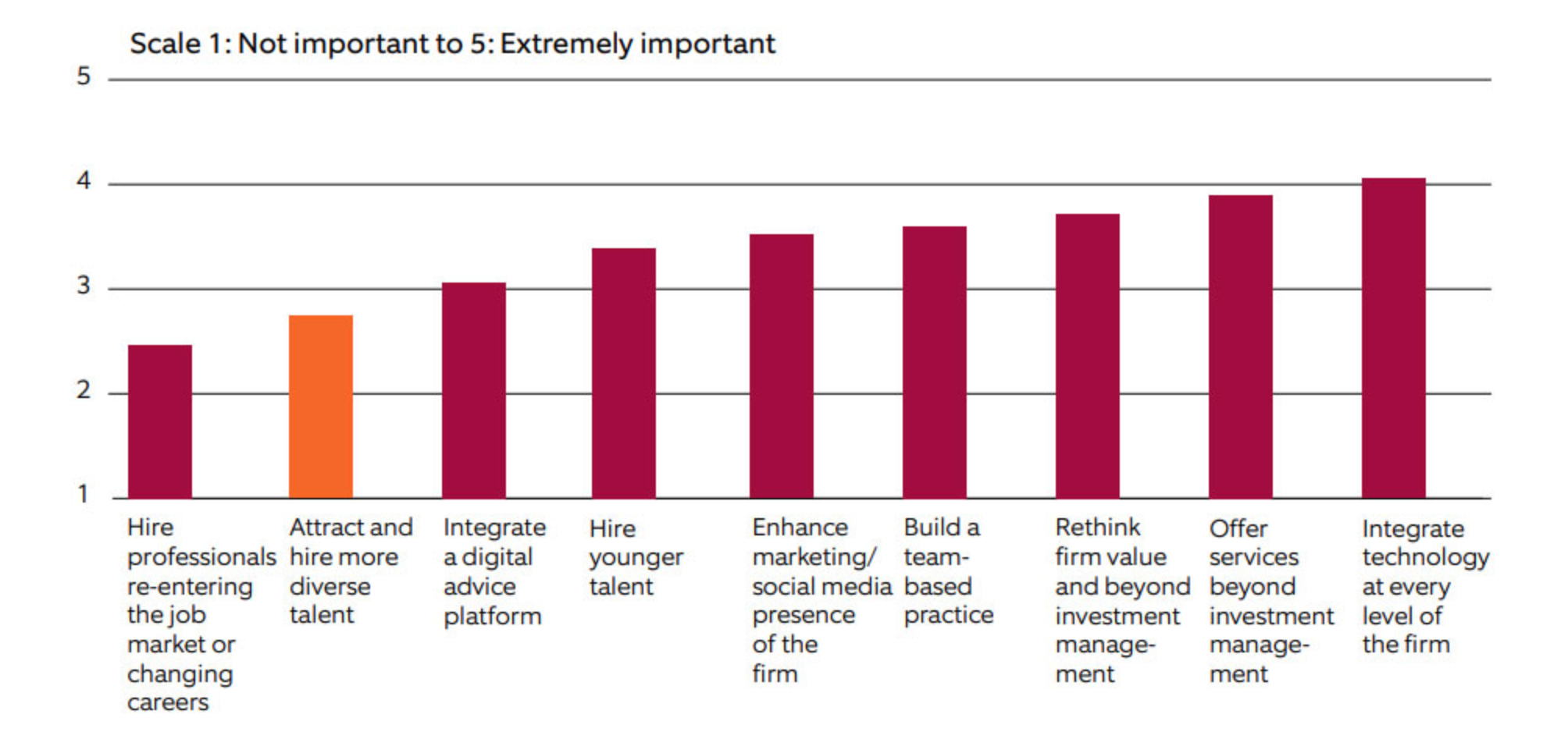

How important will success with the following initiatives be to a firm’s ability to align with the future of the industry and grow?

The study also found that advisors believe offering services beyond investment management will be the second most important key to future success, only trailing integrating technology. “People need help. They need guidance. As advisors, we can help them do more than just accumulate wealth,” says Mark VanVoorhees, CFP, senior wealth advisor at Belpointe Wealth Management in Frankenmuth, Michigan, and past personal financial planning program director, Department of Finance and Law at Central Michigan University. “We’re not just selling them investments.”

Small firms can learn from the efforts of larger firms, and they have the agility to act decisively to implement beneficial programs.

People need help. They need guidance. As advisors, we can help them do more than just accumulate wealth. We're not just selling them investments.

–Mark VanVoorhees, CFP

STEPS TO TAKE NOW

The FlexShares research suggests the following strategies to prepare your practice for the future:

Prioritize diversity

The study found that larger firms are more likely to see increasing staff diversity as a

strategic priority:

- 60% of advisors with 51–100 employees agreed with this statement, compared with about a third of advisors with fewer than six employees.

Larger firms were also more likely to make efforts to accommodate diverse staffing.

- More than half of firms with 200+ employees provide their staff with diversity and inclusion training, compared with 24% of firms with 2–5 employees.

Key Takeaways

- 60% of firms with 51–100 employees see increasing staff diversity as a strategic priority

- 24% of firms with 2–5 employees provide their staff with diversity and inclusion training

- 92% of firms with 100–200 employees say they lay out a career trajectory for young hires

Create clear career paths

Building teams for the future requires attracting and retaining top talent. “It’s one thing to say we’re going to get as many women, black and brown people, and LGBTQ folks as we can into the tent. But once they’re there, then what?” says Malcolm Ethridge, CFP, executive vice president of CIC Wealth in Rockville, Maryland, and a board member of the Association of African American Financial Advisors. “If they don’t feel like they are a part of the puzzle and the process, then you haven’t really solved the problem.”

- The FlexShares study found that larger firms are far more likely to have a clear career path for younger employees. In fact, 92% of firms with 100–200 employees say they lay out a career trajectory for young hires, compared with just 60% of firms with 2–5 employees.

Mapping out a clear path for advancement may help firms of all sizes in their recruiting and retention efforts. Ambitious professionals need to understand they are moving forward and contributing to the firm’s success. Not every advance has to be tied to greater compensation or a loftier title; consider identifying milestones that illustrate interim progress toward those achievements.

To some extent, the FlexShares study findings may reflect the fact that large firms have more career tracks available and career trajectories that are more clearly defined. But smaller firms have an advantage in recruiting ambitious candidates: flexibility.

Smaller firms may be able to offer candidates greater latitude to think entrepreneurially, to shape their own position and to help build the firm than larger firms can. In some situations, smaller practices may be better able to entice candidates with the prospect of future equity in the firm.

Broaden service offerings

Clients increasingly ask for more holistic help from their financial advisors. Given that context, it’s not surprising that respondents from firms of all sizes consider offering services beyond investment management important for the future.

- Practices with 2–5 employees consider this initiative just as important as do firms with 100 or more employees. The FlexShares Advisor Teams and Diversity Study asked advisors to score various initiatives on a scale of 1 (not at all important) to 5 (extremely important).

- Offering services beyond investment management received the second-highest

score, behind only integrating technology. Smaller firms ranked offering services

beyond investment management as highly as larger practices: Firms with 2–5,

6–10, 11–50, 101–200 and 200+ employees all scored this initiative between 3.9

and 4.1.

But large firms’ greater breadth currently enables more of them to offer a range of services.

To expand their service offerings, smaller firms may wish to consider establishing partnerships with third-party providers to outsource functions such as investment management, compliance, back-office administration or CMO/marketing. These third-party resources can free up more time for small firms to devote to their clients or other integral offerings.

FINDING FUTURE SUCCESS

Broadening their offerings and staff can position advisory practices for the future, whether advisors intend to practice for many more years or want to maximize their firm’s value for a potential sale.

Small advisory firms don’t need—or often want—to emulate everything larger firms are doing. But studying their bigger peers offers smaller firms the opportunity to choose specific strategies and tactics that will best advance their own practices.

The FlexShares Advisor Teams and Diversity Study surveyed more than 500 financial advisors and 200 investors around the country in late 2019.

¹“By Slacking on Diversity, Advisors Risk Losing Relevance.” Financial Planning, Dec. 2018.

https://www.financial-planning.com/opinion/financial-planning-industry-must-hire-and-promote-more-minority-candidates